Click here to watch video

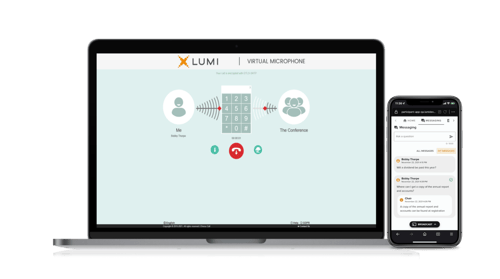

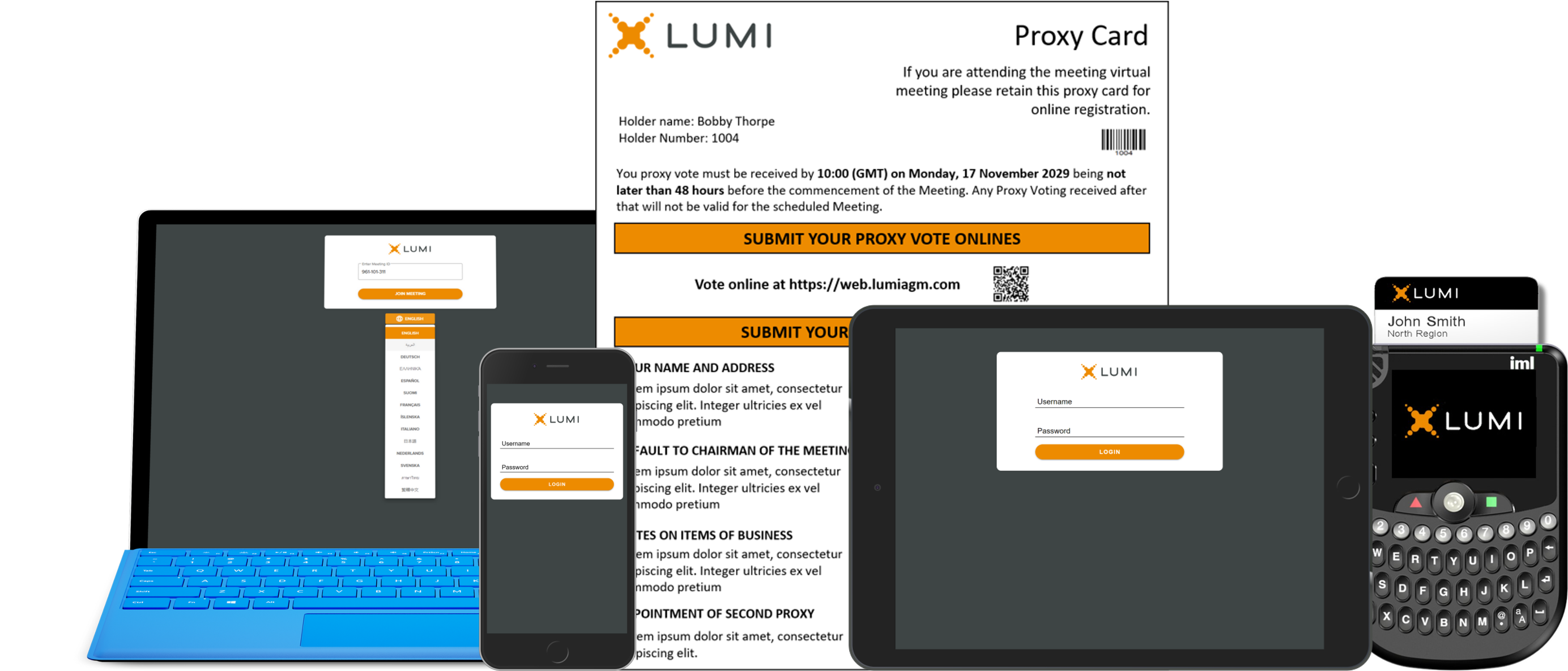

Virtual meetings are already well-adopted in many countries across the globe. All the attendees of a virtual meeting attend securely, using authenticated login credentials, via an online platform, allowing them to ask questions, vote, and participate electronically in real time, as they would do at a physical meeting. This removes the need for everyone to be in one location, making it easier and more cost-effective for shareholders to attend and engage with the meeting and the board.

A number of factors are affecting the rise of both virtual and hybrid meetings, although they differ from country to country. Here’s a couple of the major overarching factors for the rise in popularity:

Technology - Most industries have seen dramatic changes to how they operate as a result of technological advances. The first hybrid meeting was held in 2001 in the United States, but hosting, or partly hosting annual meetings online has only come into the mainstream in the last 5 years or so.

Inclusivity - Making your meeting available to everyone who wants to attend, without the constraints of travel or cost, helps to make

your organization more customer-focused.

.png?width=500&height=281&name=Untitled%20design%20(19).png)